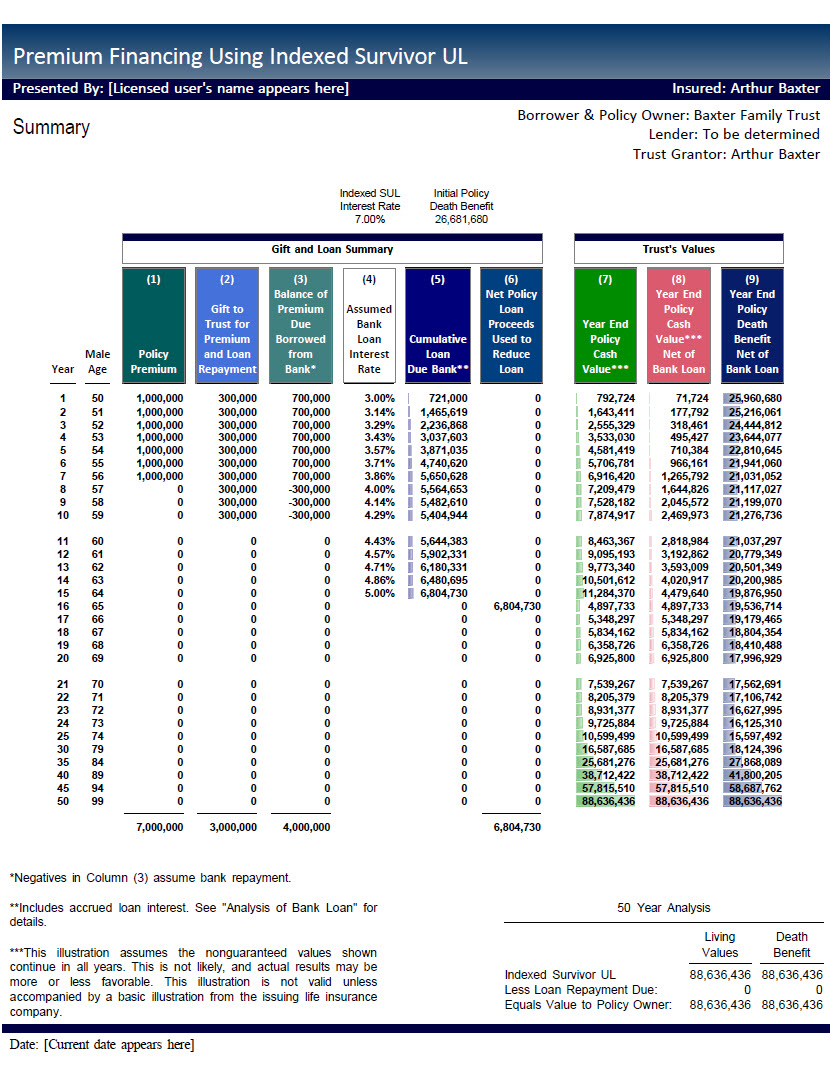

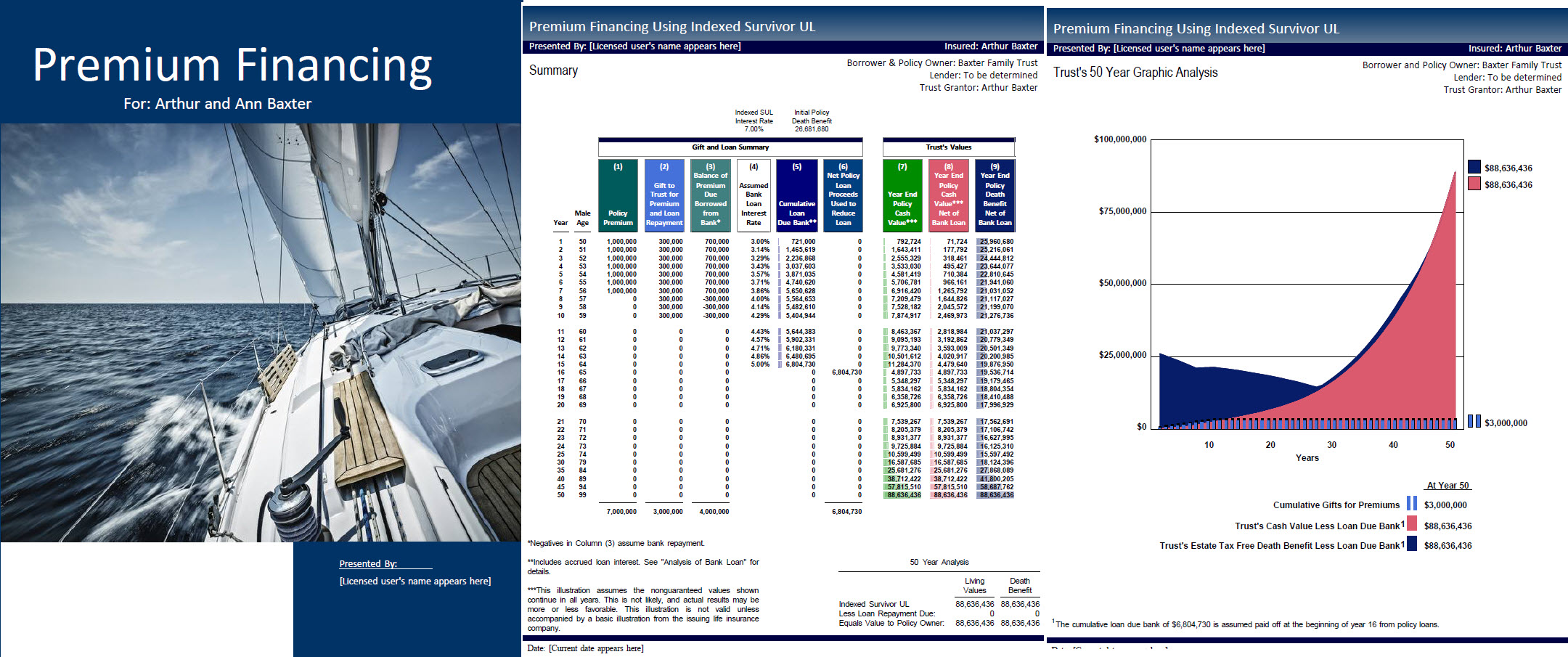

Premium Financing

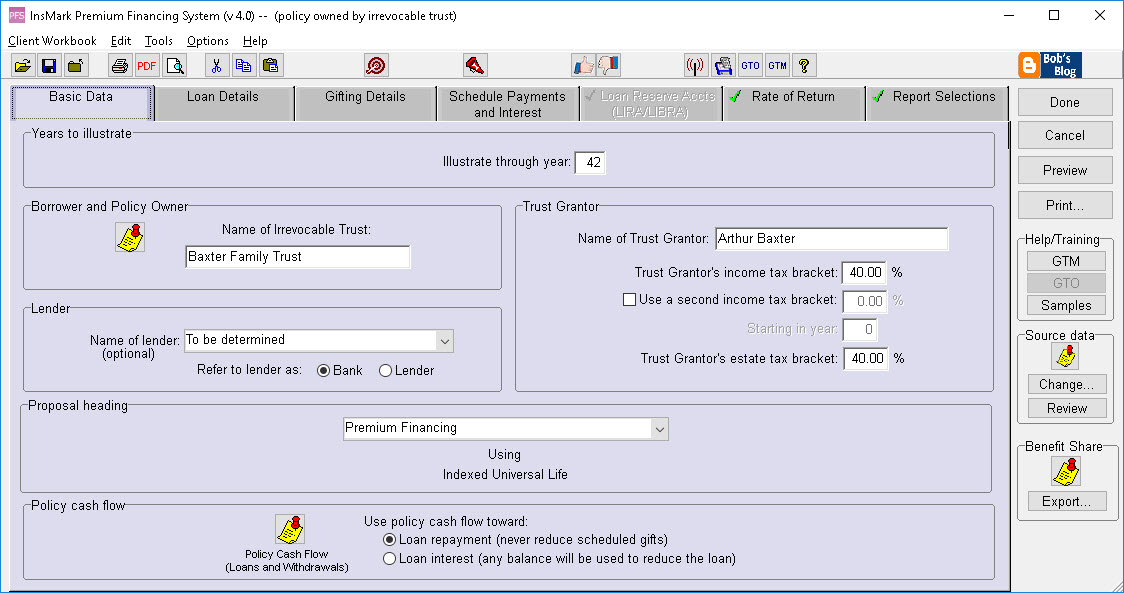

This System illustrates third-party financed life insurance owned by an individual, a company, or an irrevocable life insurance trust using any policy form desired. It also includes an illustration module in which the income tax on an executive bonus (used to purchase life insurance) is funded via third-party financing.

Take a look at what InsMark's Premium Financing can do:

Your System comes with Snap-Ons. Snap-Ons enable the instant transfer of policy data from your company's illustration software to this InsMark System.

Features

This System illustrates bank-financed life insurance. Its variations include the following:

- Policy owned by an irrevocable life insurance trust

- Policy owned by an individual or a business

Source of premiums if the policy is owned by an irrevocable life insurance trust

All premiums are paid via bank loan or part paid by bank loan and part paid by gifts from the trust grantor. (When tight credit markets occur, the option for the policy owner to pay premiums for interim periods can be a valuable option.)

Source of loan interest if the policy is owned by an irrevocable life insurance trust

- Accrued (added to the loan)

- Partially paid from gifts by the grantor with the balance accrued

- All paid from gifts from the grantor

- Paid from policy withdrawals and/or loans

The option to use some gifts -- particularly gifts within the annual exclusions and exemptions available -- is useful when you are dealing with an illustration with accrued loan interest in which the cumulative loan is projected to be uncomfortably close the collateral for the loan.

With the tightened credit markets, the option to use gifts for premium for the first two or three years, means that plans can get funded now, and when bank loans begin, the cash value frequently will remain well in excess of the cumulative loans -- even when loan interest is accrued.

With InsMark’s Premium Financing illustration, data can be imported into InsMark’s Wealthy and Wise® System where it can be compared using “don’t-do-it” versus “do-it” logic. The don’t-do-it analysis involves a projection of Net Worth and Wealth to Heirs without regard to the Premium Financing. The do-it analysis involves re-projecting Net Worth and Wealth to Heirs including the premium financing data. Rather than presenting the Premium Financing illustration as an isolated transaction, by comparing its impact on Net Worth and Wealth to Heirs within Wealthy and Wise®, clients can review an integrated analysis of its powerful results.

Note: The effect of InsMark’s Premium Financing illustrations funded partly with gifts in excess of the available annual exclusions and exemptions can also be analyzed for its effectiveness within Wealthy and Wise®.

Source of premiums if the policy is owned by an individual or business

All premiums are paid via bank loan or part paid by bank loan and part paid by the policy owner.

Source of loan interest if the policy is owned by an individual or business

- Accrued (added to the loan)

- Partially paid by the policy owner with the balance accrued

- All paid by the policy owner

- Paid from policy withdrawals and/or loans

Note: An individually owned policy funded by a bank loan arranged by the business produces a dynamic executive benefit.