Wealthy and Wise - Advanced

Wealthy and Wise - Advanced

The missing piece in your client conversations: real-world home equity scenarios inside Wealthy and Wise® Advanced.

Access $35 trillion of home equity through a powerful new low-cost equity liquidation product called CHEIFS® that integrates with Wealthy and Wise® Advanced. Watch the video below to learn how this works and why you have to be in this market today.

The Power of CHEIFS Inside Wealthy and Wise Advanced.

One of the most exciting new features in Wealthy and Wise Advanced is the integration of CHEIFS® (Cornerstone Home Equity Insurance/Investment Funding Solutions).

With more than $35 trillion in dormant U.S. home equity, clients often hold their largest asset in a form that's hard to use. Until now, the choices were limited: sell the home, take out a HELOC, or consider a reverse mortgage — all debt-based solutions with trade-offs.

CHEIFS provides a new option. It lets clients convert a portion of their home equity into retirement income, protection, annuities, or estate planning strategies — all without loans, interest, or monthly payments.

Inside Wealthy and Wise® Advanced, advisors can:

- Model “status quo” vs. CHEIFS-funded plans

- Demonstrate potential improvements in net worth, liquidity, and legacy

- Customize scenarios by age, goals, and risk profile

- Show clients how home equity strategies can strengthen their balance sheet and long-term financial security

- Document best interest and due care standards

This makes Wealthy and Wise Advanced the first planning platform to integrate non-debt home equity strategies into a client’s financial roadmap — giving advisors a clear, competitive advantage.

Powered by

Clear Comparisons. Confident Decisions.

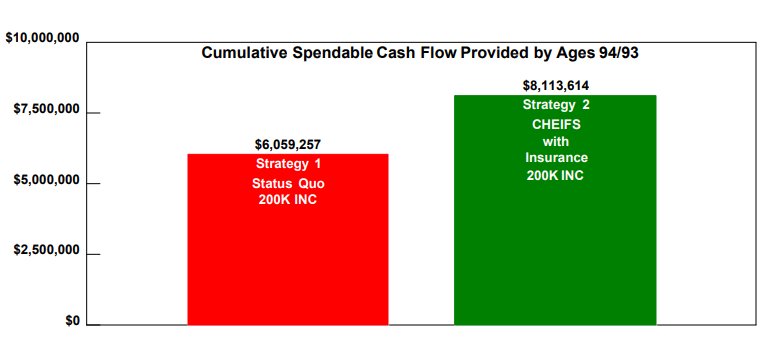

Demonstrate the Power of CHEIFS in Real Numbers

Wealthy and Wise Advanced allows you to model a client’s status quo alongside a CHEIFS-funded strategy.

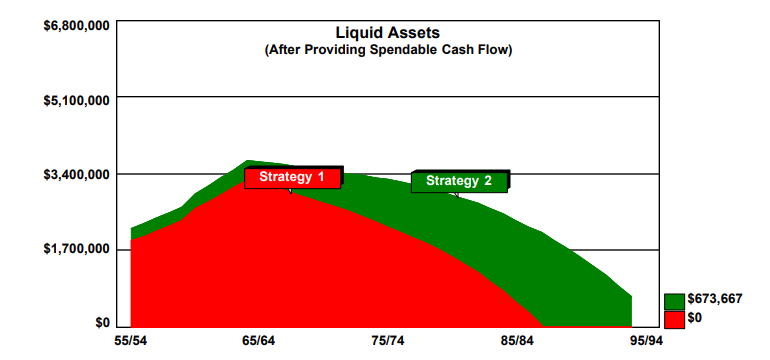

Liquidity Impact | Spendable Cash Flow |

|

|

|  |

Download the full case study | |

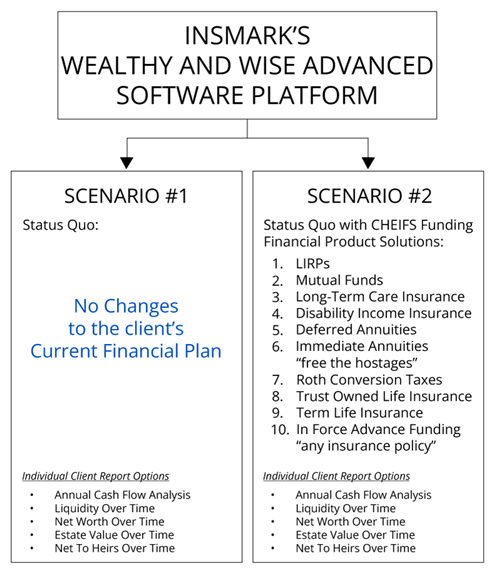

Use CHEIFS Home Equity to "Find the Money"

For One or More

Financial Product Solutions

(see Scenario #2 below)

48 Strategies. One Powerful Platform

Wealthy and Wise Advanced combines the proven 40 strategies of Wealthy and Wise with 8 advanced planning modules, including:

CHEIFS® - Convert home equity into liquidity and protection without debt

Intentionally Defective Grantor Trust (IDGT)

Discounted Sales of Illiquid Assets to an IDGT

Charitable Bequest & Zero Estate Tax Plans

Premium Financing (personal & bank loans)

Annuity Rescue Plans

Retirement Plan Rescue Plans

Advanced Estate & Legacy Comparisons

Frequently Asked Questions

Q: Does CHEIFS involve debt or monthly payments?

No. CHEIFS is a non-debt funding solution — no HELOCs, reverse mortgages, or loan payments.

Q: Can I use Wealthy and Wise Advanced for strategies beyond CHEIFS?

Yes. CHEIFS is just one of 8 new advanced modules added to the 40+ strategies already built into the system.

Resources

1 | 2 | 3 | 4 | 5 |

Technical | CHEIFS | WAW | Monthly Webinar | Case Design Assistance | Case Consultants |

| email:support@insmark.com phone: 925-543-0507 | Access Forum | List of Webinars | Request Assistance | NextPoint Solutions |

* Case splits are typically 25% for case design only and 35% for case design and client/advisor interaction.