Wealthy and Wise+

Be the Trusted Advisor

Helping Clients

Erase Their #1 Retirement Fear *

* Now more than ever, your clients fear running out of money during retirement. Wealthy and Wise+ can help you model different scenarios to solve this problem including the new CHEIFS home equity integration which can significantly increase your client’s income and liquidity during their retirement years. Watch the video above to learn more.

Wealthy and Wise+ is the “must-have” software platform for every financial advisor regardless of whether that advisor is managing money or selling financial products (mutual funds, annuities, life insurance, etc.)

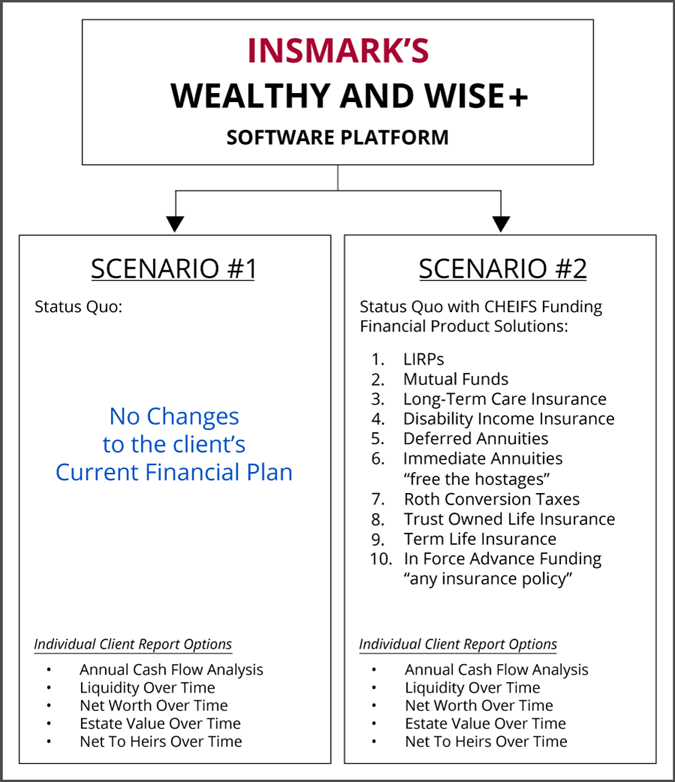

See below to understand the Financial Models that you can create in Wealthy and Wise+.

BONUS!

InsMark’s online Client Data Questionnaire (CDQ) makes getting information from your clients easier than ever before. CDQ is now included and integrated into Wealthy and Wise+. Users tell us that just CDQ is worth the price of WAW+.

With Wealthy and Wise+,

You Can Easily Build the Following Financial Models:

Scenario #1: This is the status quo where you enter the client’s existing assets, liabilities, and future retirement income needs. You will also enter investment return and tax assumptions. Then, you can project into the future and show how the client’s liquidity and long-term net worth grow or shrink over time (and if they run out of money during retirement, most client’s #1 fear).

Scenario #2, #3, #4, etc.: Here, you can make your recommended changes to the client’s investment, retirement and estate plan (when applicable) and show whether your suggestions will improve the client’s long-term results (more income, higher net worth, lower estate taxes, etc.). Your suggestions could be to have the client work a few more years, or reduce their spending. It could also include switching some of their mutual funds to a Universal Life policy or a life income annuity for higher income and lower risk. You become the coach and analyst for how your client will plan a successful and safe retirement (including reviews at least annually to monitor results and consider new alternatives).

Of course, you will have some clients that have sufficient wealth, and they don’t fear running out of money during retirement. However, these clients have a different problem and are wrestling with estate taxes, trusts and how to make sure that their wealth goes to the people or causes most important to them.

See the video below showing how one of the top advisors in the country uses Wealthy and Wise+ with this type of affluent client.

Discover How to Redeploy a Portion of

Your Clients Dormant Home Equity into

Improved Net Worth, Liquidity, and Legacy

(Advisors gain clarity — clients see their future results transform)

Top Financial Advisor Explains How He Uses

Wealthy and Wise+

to Show the Impact of Different

Estate Planning Recommendations

(Clients see in real-time, the massive positive impact you can have on their future results)

Ricardo Garcia with FFG Shows the Power of

InsMark’s What-If Calculator

to Protect Clients Current Savings and Future Work Income

(A Perfect Introduction to Wealthy and Wise+)

How Wealthy and Wise+ Works

1 | 2 | 3 | 4 |

Current Financial Position Overview | Personalized Guidance for Financial | Conduct Yearly Assessments | Everyone Can Easily Comprehend |

Wealthy and Wise+ Net Worth Analysis

Show your clients their retirement options side-by-side

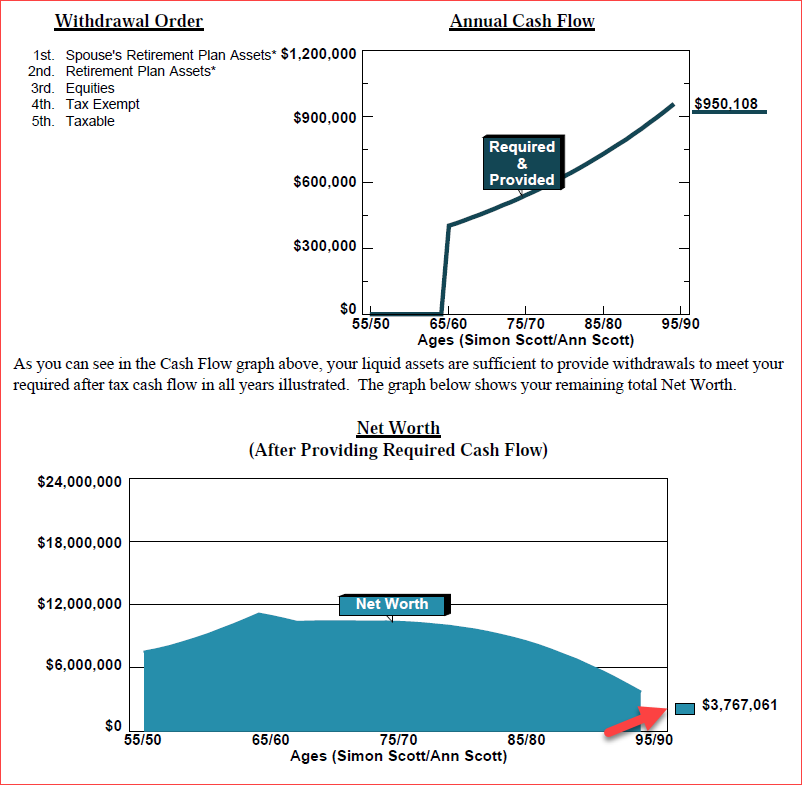

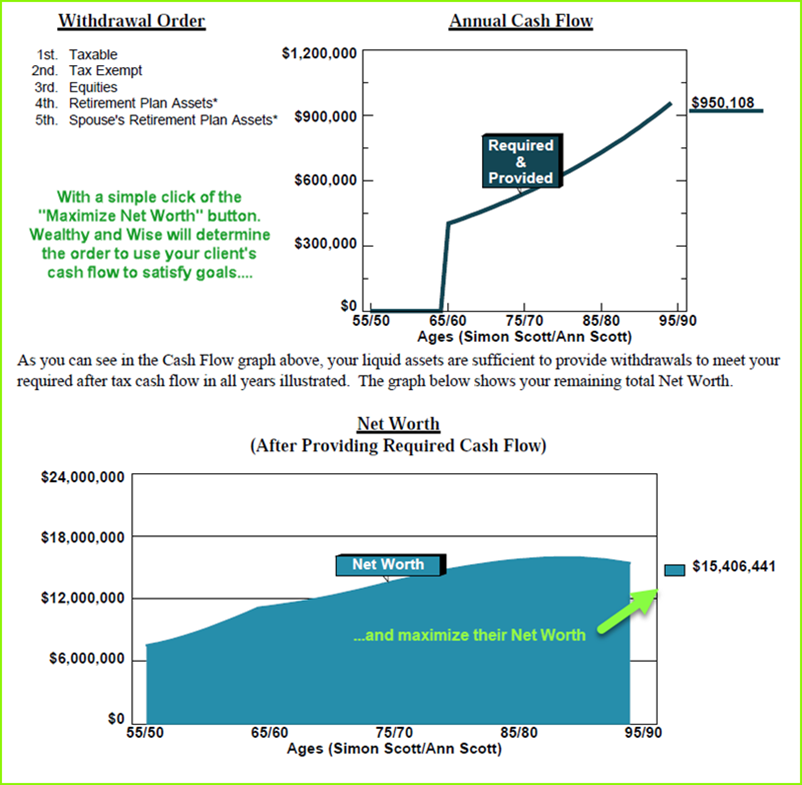

Bad LogicNet worth if you withdraw assets inefficiently Age 95 Net Worth: $3,700,000 One of the greatest features in Wealthy and Wise+ is its ability to optimize your client's Net Worth simply by testing the best order in which your client should use their assets to fulfill their precise financial goals. This is a detail that is almost impossible to calculate manually and is typically ignored. As you can see in the report below, spending the assets in an un-optimized order (listed top left) will result in a Net Worth of a little over 3.5 million dollars at the end of the Analysis. Not bad, HOWEVER ... | Good LogicNet worth if you optimize asset withdrawal Age 95 Net Worth: $15,000,000 ... Wealthy and Wise+'s unique optimization ensures the client's Net Worth is maximized. In the case below, the optimized Net Worth is significantly increased by over 11.5 million dollars to a total Net Worth of over 15 million. WOW! This feature alone proves the value of a Wealthy and Wise+ Analysis for your clients (and your commissions), thus making the purchase a "no-brainer". | ||

|  |

Download the full case study to your computer.

Questions? Contact Julie Nayeri at InsMark (julien@insmark.com or 925-543-0514)

Craft the perfect strategy to guide your clients to success . . .

- Test for Sustainability of Cash Flow Goals

- Test Financial Tolerance for Gifting

- Measure the Impact of any Strategy on Pre-death Net Worth

- Compare Alternative Wealth Accumulation and Distribution Strategies

- Compare Alternative Wealth Preservation Strategies

- Compare Plans With and Without Life Insurance (in or out of the estate)

- Measure the Impact of Taxable Gifts Compared to No Gifts

- Illustrate Premium Financing using Bank Loans

- Compare Tax Deferred w/ Taxable, Tax Exempt, and Equity Alternatives

- Calculate After Tax Social Security Retirement Benefits

- Calculate After Tax Income from Single Premium Immediate Annuities (no refund or period certain)

- Calculate Estate Value of Period Certain Annuities

- Illustrate IRAs, Roth IRAs, 401(k)s, Keoghs, and Defined Benefit Plans

- Compare IRAs vs. Roth IRAs (including impact on heirs)

- Illustrate Inherited IRAs and Inherited Roth IRAs

- Analyze Retirement Plan Accum./Distribution Strategies

- Evaluate Charitable IRA

- Evaluate Stretch-Out IRA

- Compare Stretch-Out IRA to Charitable IRA

- Evaluate Charitable Bequests of Annuity Assets coupled with a Wealth Replacement Trust

- Evaluate Zero Estate Plans Funded by Charitable Gifts and a Wealth Replacement Trust

- Evaluate Charitable Remainder Trusts

- Analyze Charitable IRA Rollovers

- Compare Alternative Charitable Strategies

One-click calculations for charitable bequests of specific liquid and illiquid assets

- Compare Spending Retirement Plan Assets Quickly vs. As Slowly As Possible (RMDs)

- Analyze Multiple Taxable, Tax Exempt, Tax Deferred, and Equity Accounts

- Measure Impact of Portfolio Turnover on Equity Performance

- Compare Variable Annuities with Equity Accounts

- Analyze Premium Financing Arrangements Funded by Personal Loans (Loan-Based Private Split Dollar)

- Evaluate 1035 Annuity Exchanges

- Evaluate Retirement Plan Rescue Plans (with life insurance in and out of the estate)

- Evaluate Annuity Rescue Plans (with life insurance in or out of the estate)

- Analyze Insure vs. Self-Insure (e.g., Long-Term Care, Disability Income, Life Insurance)

- Compare Term vs. Permanent Insurance

- Compare Year-By-Year Death Tax with Liquid Assets Available to Pay the Tax

- Include Graphs, Bar Charts, and Pie Charts to Compare the Impact of Different Strategies on Net Worth, Transfer Taxes, Wealth to Heirs, and Wealth to Charity

Go Further With Advanced Strategies

- NEW! Model non-debt home equity funding strategies with CHEIFS

- Intentionally defective grantor trust (IDGT)

- Gifts of current liquid and illiquid assets to the IDGT

- Discounted sales of illiquid assets to an IDGT

- Include single life and survivor life insurance in the IDGT

- Grantor access to the IDGT using withdrawals from specific assets

The Power of CHEIFS Inside Wealthy and Wise+

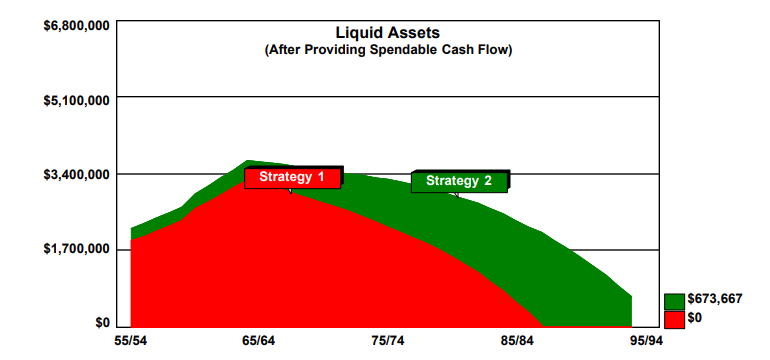

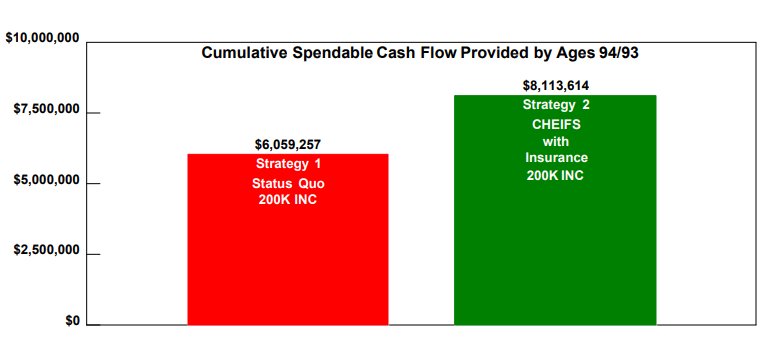

One of the most exciting new features in Wealthy and Wise+ is the integration of CHEIFS® (Cornerstone Home Equity Insurance/Investment Funding Solutions). CHEIFS is a unique home equity access program: patent-pending, non-debt home equity strategy designed for advisors who need a compliant way to help clients convert a portion of their home equity into liquidity without loans, interest, or monthly payments.

With more than $35 trillion in dormant U.S. home equity, clients often hold their largest asset in a form that’s hard to use. Until now, the choices were limited: sell the home, take out a HELOC, or consider a reverse mortgage — all debt-based solutions with trade-offs.

CHEIFS provides a new option. It lets clients convert a portion of their home equity into retirement income, protection, annuities, or estate planning strategies — all without loans, interest, or monthly payments.

Inside Wealthy and Wise+, advisors can:

- Model “status quo” vs. CHEIFS-funded plans

- Demonstrate potential improvements in net worth, liquidity, and legacy

- Customize scenarios by age, goals, and risk profile

- Show clients how home equity strategies can strengthen their balance sheet and long-term financial security

- Document best interest and due care standards

This makes Wealthy and Wise+ the first planning platform to integrate non-debt home equity strategies into a client’s financial roadmap — giving advisors a clear, competitive advantage.

Powered By

Clear Comparisons. Confident Decisions.

Demonstrate the Power of CHEIFS in Real Numbers

Client’s status quo (Strategy 1)

Vs.

CHEIFS-funded plan (Strategy 2)

| Liquidity Impact |

|

Spendable Cash Flow |

|

Questions? Contact Julie Nayeri at InsMark (julien@insmark.com or 925-543-0514)

Use CHEIFS Home Equity to "Find the Money"

For One or More

Financial Product Solutions

(see Scenario #2 below)

1 | 2 | 3 | 4 | 5 |

Technical | InsMark Forum | Monthly Webinar | Case Design Assistance | Case Consultants |

| email: support@insmark.com phone: 925-543-0507 | Access Forum | List of Webinars | Request Assistance | NextPoint Solutions |

* Case splits are negotiated on a case-by-case basis and will depend on how much involvement the consultant has with your client and advisors.